How to Buy Crypto Anonymously (Part 1)

Explore the pros and cons of buying crypto with ATMs, P2P marketplaces, OTC desks, and other methods while keeping your privacy intact.

Bottom Line: One‑Minute Summary

Regulators crack down on privacy in finance, making it harder to buy crypto anonymously. Yet, a few practical routes still exist, and the size of your purchase determines the most efficient approach.

Small to medium cash buys (≤ $10,000)

- Buy at a Bitcoin ATM that does not require any identification or a P2P platform such as Bisq or Robosats. Typical fees are between 4% to 10% for ATMs and 0.5% to 2% for P2P trades. Your identity stays off-record, and the coins can be moved straight into a hardware wallet.

Large cash buys (> $10,000)

- OTC desks: Use OTC desks that accepts cash and do not require KYC. Spreads are usually 1% to 3%.

- Trade with family, friends, or trusted Bitcoin miner. While not fully anonymous, a cash‑deal via a discreet meeting keeps KYC to a minimum and preserves a high degree of privacy.

All‑size fiat buys (KYC‑verified)

- If your funds are already on a bank account and you can prove their origin, I suggest you just go ahead and buy for low fees on Centralized Exchanges (CEX) and anonymize your crypto one step later. Buy on CEXs like Kraken, Coinbase, or Binance. Trading fees start at 0.1 %. Then transfer the coins to a hardware wallet and anonymize them via privacy protocols like Railgun, privacypools, or mixer services. I am currently working on a post that walks you through the exact steps to anonymize your coins once you have them (I'll publish it at the end of 2025).

Tainted coins

A coin you acquire could have been linked to illicit activity, so treat it as tainted to be on the safe side. Keep it separated from your other crypto funds and only sell it through a privacy‑focused P2P or no‑KYC OTC channel. Do not deposit it into a custodial exchange. This keeps your crypto out of reach from potential freezes or regulatory inquiries.

Read on to learn the pros and cons of each method, and see the reasoning behind my choices.

Questions, ideas, or feedback? Reach me at cassius.nox@tuta.com.

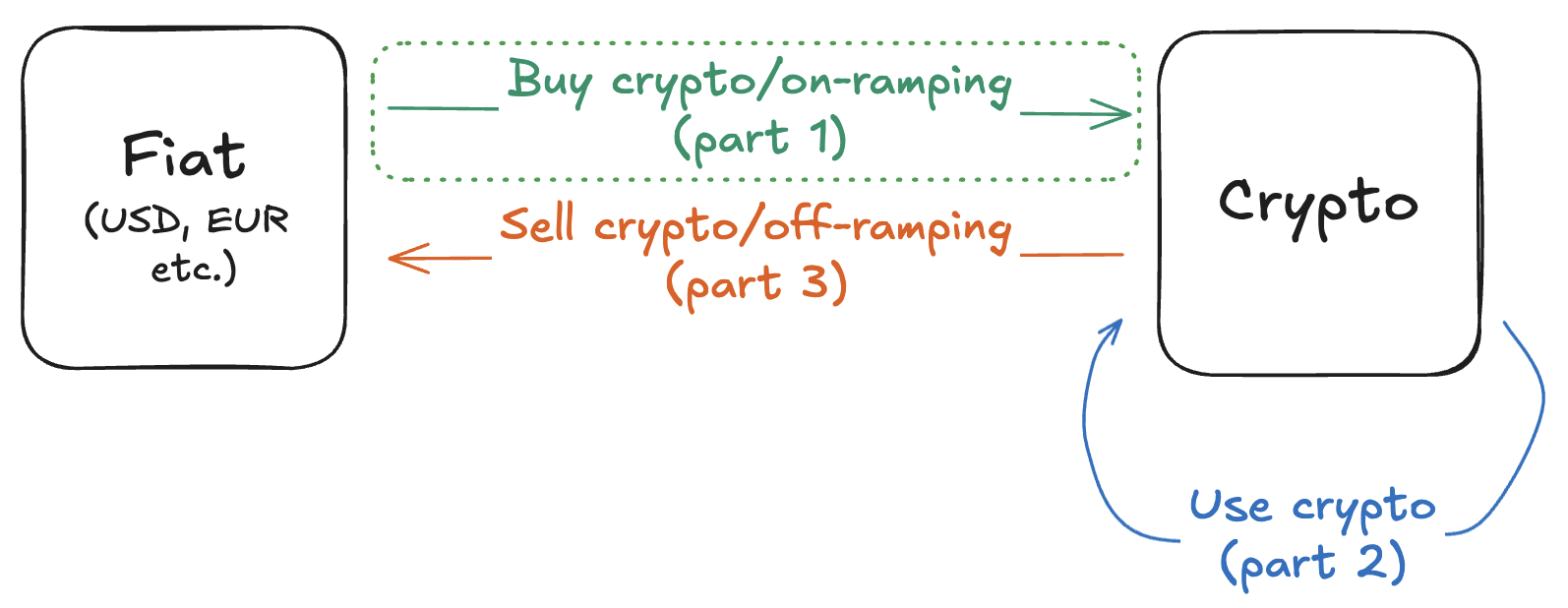

Intro - A Three-Part Series To Private Crypto Transactions

This series is divided into three parts: buying crypto (part 1), using it (part 2) and selling it back to fiat (part 3). In each post I examine methods from a privacy‑first perspective.

Post Overview: Buying, Using & Selling

If anonymity isn’t your priority and you already hold fiat in a bank account, you can skip this installment. In that case, the simplest low‑fee route is to use centralized exchanges such as Kraken, Coinbase, Binance or KuCoin; however, the lack of privacy exposes you to significant risks.

Why Should You Care About Privacy?

Centralized power leads to corruption, as described in Why Privacy Matters. Nowhere is this more evident than in our financial system. When central banks and regulators dictate who may participate, they create a system that systematically excludes, surveils, and manipulates: debanking innovators, flagging legitimate transactions under Anti‑Money‑Laundering rules, and steadily inflating the money supply to expropriate citizens.

Cash is becoming increasingly restricted precisely because it cannot be controlled effectively. Luckily, cryptocurrencies have emerged as a digital alternative to both cash and gold that offer financial autonomy protected by decentralized technology that resists centralized authority.

But this freedom brings its own challenges. In the crypto world, privacy isn’t nice-to-have, it’s a necessity. Lack of privacy exposes crypto holders to real risks: high-profile cases like the kidnappings of David Barrant (co-founder of Ledger) and Dean Skurka (CEO of WonderFi) demonstrate how publicizing your wealth or activities can make you a target.

In this post I outline and analyze practical strategies for acquiring crypto while keeping data exposure to a minimum. These methods protect your financial autonomy, and personal safety.

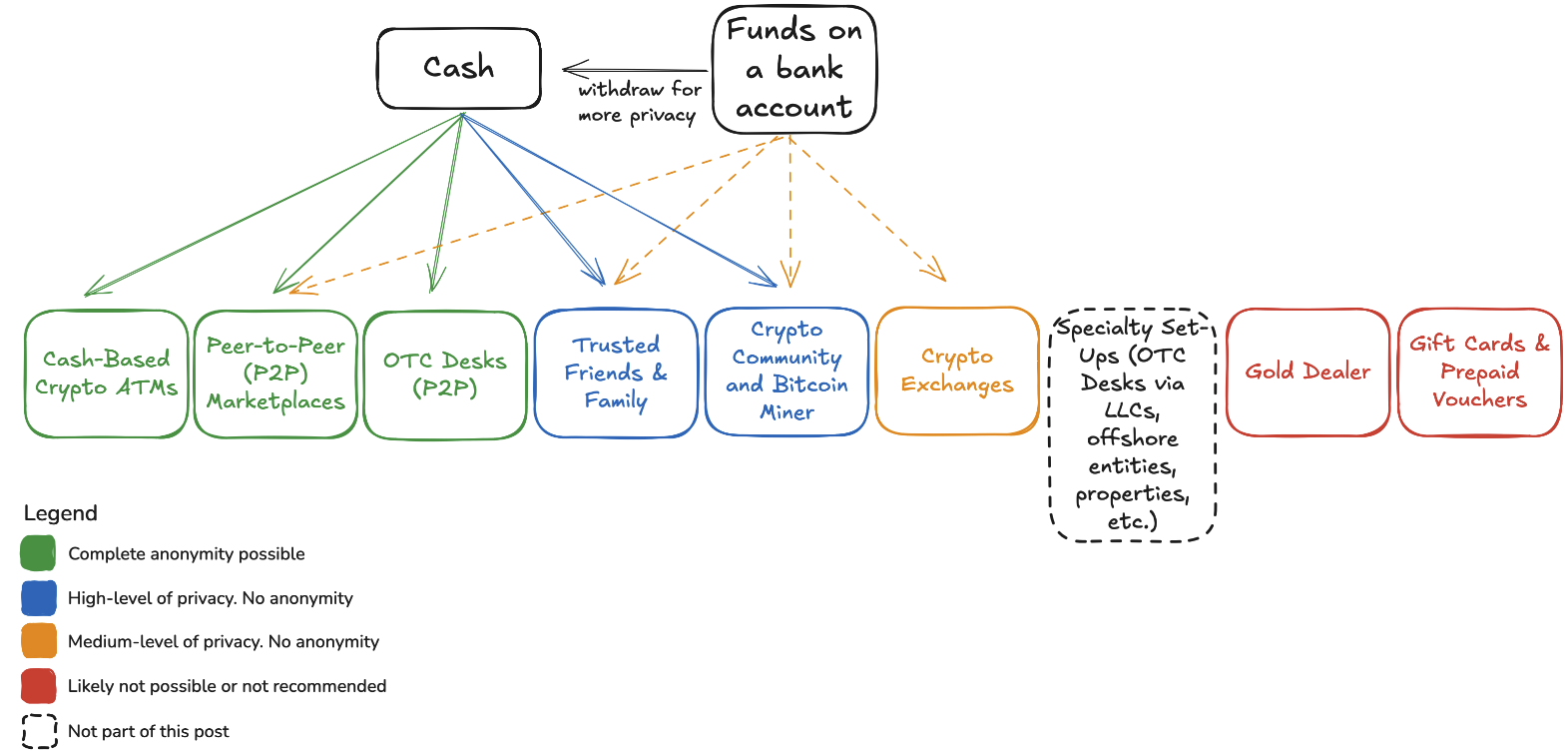

Methods To Buy Crypto Anonymously

Overview: Methods To Buy Crypto Anonymously

Crypto ATMs (cash-based)

Crypto ATMs are a practical way to buy small amounts of crypto anonymously. However, finding one that does not ask for personal data (KYC = Know-Your-Customer) and has reasonable fees can be tricky depending on where you live. Bitcoin ATMs are the most common type and usually have the lowest fees among crypto ATMs.

Pro:

- Complete anonymity possible.

Con:

- High fees:

- US: 15%-20% fees for buying.

- Europe: 4%-10% (e.g., Czech Republic, Spain, Poland).[1]

- Low transaction limits: Usually capped between $250 to $2500 per transaction. Multiple trips may be necessary for larger purchases.

Process (Bitcoin ATM)

Step 1: Locate an ATM that does not require personal identification

- Use Coin ATM Radar to find ATMs in your area.

- Check the ATM’s details (via the “Bitcoin Machine Details” section) to confirm if any form of registration, ID or SMS verification is required. Avoid these.

Step 2: Prepare a secure wallet

- Generate a new Bitcoin wallet address using a hardware wallet (e.g., Trezor, Ledger) or offline wallet generators like Electrum.

Step 3: Use the ATM

- Disable location services on your phone and use a VPN to prevent anyone from linking the transaction to where you are.

- Disguise yourself: Many ATMs are in malls or areas with camera surveillance. To keep your identity private wear a hat and sunglasses. If you’re feeling extra cautious, an anti‑facial‑recognition mask works too.

- Don't share personal info: Don't provide your phone number or other identifying detail. If SMS verification is required, try temporary SMS services like Temp Number.

P2P Exchanges & Marketplaces

P2P exchanges and marketplaces offer a privacy-first solution for trading small to medium Bitcoin amounts. Platforms like Bisq, Robosats, and HodlHodl prioritize decentralization, anonymity, and user control, though each has distinct trade-offs.

- Bisq and Robosats are fully permissionless, requiring no KYC.

- Bisq (and its simplified version, Bisq Easy) caters to advanced users with desktop software, offering full control over trades.

- Robosats provides a smoother user experience via the Tor browser but requires a Lightning-compatible wallet for its escrow system.

- HodlHodl balances ease of use with centralized dispute resolution: funds are held in a 2-of-3 multisig (buyer, seller, HodlHodl team), introducing a minor KYC risk during disputes. It uniquely supports face-to-face cash trades, which can reduce KYC exposure when executed discreetly.

In-depth comparison between Bisq (Bisq 1 and Bisq Easy), Robosats and HodlHodl

| Bisq | Robosats | HodlHodl | |

|---|---|---|---|

| Description | Bisq 1: P2P Bitcoin exchange; non-custodial; 2-of-2 multisig escrow; BTC security deposit required; no KYC Bisq Easy (Bisq 2): For novice users wanting to trade small amounts of Bitcoin, with no BTC security deposits required. It offers the same privacy functionality as Bisq 1 |

P2P Bitcoin exchange on Lightning; non-custodial via hodl-invoices; Tor-only access; open-source; no KYC. BTC security deposit required |

P2P Bitcoin marketplace; non-custodial; 2-of-3 multisig escrow; no KYC by default, but may be requested for dispute resolution or suspicious activity |

| Fees & Spread |

Bisq 1: - Trade fee: 1.3% in BTC or 0.65% in BSQ - Mining fee: 0.000069 BTC (~8 USD at 100k USD BTC price) - Spread: Min. 0-2% Bisq Easy: Starting at ~5% |

- Trade fee: 0.2% (0.175% for order taker, and 0.025% for order maker) - Spread: Min. 0-1% |

- Trade fee: 0.5% - Spread: Min. 1% |

| Limits per trade |

Bisq 1: Up to 0.0624 BTC (~6,240 USD) for most payment methods Bisq Easy: Up to 600 USD |

Up to 5,000 USD | Max 5. BTC (~500,000 USD) |

| Payment methods |

- Many traders offer: Bank transfers (SEPA, SEPA Instant, ACH, SWIFT), Neobanks (Wise, Revolut), Instant-pay apps (Zelle, Venmo, Cash App), etc. - Rare to find: Cash by mail - Not available: Cash face to face |

- Many traders offer: Bank transfers (SEPA Instant, ACH, SWIFT), Neobanks (Wise, Revolut), Instant-pay apps (Zelle, Cash App), etc. - Not available: Cash face to face |

- Many traders offer: Bank transfers (SEPA, SEPA Instant, ACH, SWIFT), Neobanks (Wise, Revolut), cash face-to-face, etc. |

| Anonymity | - Fully permissionless, peer-to-peer, and requires no KYC. Identities are obscured by Tor and no personal data is collected - Payment methods like bank transfers may reveal your name to the counterparty |

- Fully permissionless, peer-to-peer, and requires no KYC. Access via Tor and no personal data is collected - Payment methods like bank transfers may reveal your name to the counterparty |

- While KYC is not default, it can be requested for dispute resolution or suspected illicit activity - Trades happen over clearnet (no built-in Tor routing) and an email for sign-up is required - Payment methods like bank transfers may reveal your name to the counterparty => Use VPN and a no KYC email address for sign-up |

| Usability | - Desktop client - Bisq 1 is for advanced users and Bisq Easy for novices |

- TOR only - Web-based platform (no software install required) |

- Browser - Web-based platform (no software install required) |

| Trust Model | - Trades use a two-step escrow, your trade amount plus a security deposit (both buyer and seller), refunded if all goes well - Trust is distributed among community arbitrators, and funds are in a 2-of-2 multisig until dispute time |

- Trades utilize a Lightning Network escrow system, locking funds with two hold invoices: one for a security deposit from both parties and one for the trade amount - Trust is distributed among community arbitrators in the event of a dispute, with the losing party forfeiting their security deposit |

- Trades use a single-step escrow of the trade amount in a 2-of-3 multisig (buyer, seller, HodlHodl), with no separate security deposit - Trust is centralized in HodlHodl staff, who hold the tiebreaker key and resolve any disputes |

P2P Platform Comparison. Download the table as PDF here.

For your own research on P2P platforms start at kycnot.me. KYCnot.me is a directory of online services that do not require KYC identity verification. It includes a privacy ranking of services and compares services by privacy and usability features.

Key Risks & Mitigation

Most users buy and sell crypto using Bank transfers (e.g., SEPA, ACH). It is the quickest and easiest payment method, but it comes with two key risks:

- Counterparty visibility: Your name is revealed to the other party through transaction details.

- Bank account freezes: While rare, banks might flag or freeze accounts for suspicious activity, especially if you conduct trades frequently.

Mitigation Strategies

- Avoid using your primary banking account: Open a secondary account at a local (community) bank where you can walk into a branch and personally clarify potential issues. Paying a small fee for the account incentivizes the bank to avoid freezing it, as they’d lose business if they do.

- Never include crypto-related terms in transaction descriptions: Leave the description field blank.

- Do not use chargeback‑prone methods such as PayPal or other platforms with dispute‑resolution mechanisms that could reverse trades; the same applies to gift cards, which can be blocked by issuers due to the risk of cash‑back fraud.

- If your account is frozen, be prepared to explain the transaction. You can describe the transaction in a technically accurate way that avoids explicitly mentioning cryptocurrency, such as stating that you paid for a "database editing", "data entry" or "data transfer" service.

Avoid centralized exchanges: Platforms like Binance P2P, OKX P2P, and Paxful enforce KYC policies.

Verdict

- Bisq 1: Best for advanced users seeking full control and privacy.

- Bisq Easy: Best for novice users buying BTC for up to 600 USD.

- Robosats: Good alternative to Bisq offering the same level of control and privacy. Easier to use, but requires Lightning wallet.

- HodlHodl: Easiest to use but requires accepting a minimal KYC risk.

- Honorable mention: Retoswap. I have not tested it yet but it looks like a potential option.

Crypto OTC Desks (P2P)

If you have a large amount of fiat and want to buy crypto, Kraken OTC, and Coinbase Prime are two reputable OTC services with competitive rates. Using these is the most straightforward and secure way to buy large amounts of crypto, however, these require KYC.

If you want to preserve your privacy, you should look to purchase through an OTC P2P system, that does not require KYC. However, you are trading noKYC with increased transaction costs and execution risks.

Quick note: I haven’t personally tried these OTC P2P desks yet. The insights come from my research into how one might buy large amounts of crypto anonymously with fiat. As always, double‑check everything for yourself before proceeding.

Best for privacy: Trade cash for Monero (EUR/USD to XMR)

- Pro:

- Completely anonymous.

- Lower risk of tainted coins. Tainted coins are those linked to illicit activity; Monero can’t be tainted because of its ring signatures and stealth addresses, but swapping it for BTC or ETH may introduce taint). Jump to tainted coins chapter to learn more.

- Con:

- Higher fees and less liquidity than Bitcoin (4-10%).

- Requires additional trading step if you want crypto like BTC or ETH. Use swappers.

Lowest fees: Trade cash for Bitcoin (EUR/USD to BTC)

- Pro:

- Completely anonymous.

- Lower fees and higher liquidity than Bitcoin (1-5%).

- Con:

- Risk of receiving tainted coins.

- In-person execution risk.

OTC P2P desks that are recommended by some users in OffshoreCorpTalk:

You can check this review site for the best EUR (cash) to BTC and USD (cash) to BTC exchange rates.

Should I pay via bank transfer?

I do not recommend using bank transfers for large crypto purchases through OTC P2P desks. These desks often require KYC or perform spontaneous “shotgun” checks. Even if they do not collect your personal data, the bank still records your name and can freeze the account for suspicious activity. If that happens you will have to explain the transfer, which defeats anonymity. In such cases it’s usually simpler to use a cheaper centralized exchange like Kraken or Coinbase. Moreover, OTC P2P desks expose you to the risk of receiving tainted coins, an issue that does not arise when using a centralized exchange.

Trusted Family & Friends

Buying crypto from someone you already know is often the quickest way to keep a transaction private, especially if that person already holds coins and wants to stay out of KYC processes of centralized exchanges.

Once you found a trade partner among your family or friends, the two key decisions are how you pay (cash or bank transfer) and how you phrase the transaction to minimize detection and legal risk.

Choosing the Payment Method

| Cash + Family/Friends | Bank Transfer + Family/Friends | |

|---|---|---|

| Privacy | High - no digital trail | Medium - bank records exist |

| Legal Risk | No | Yes - the transfer is recorded by banks. Leave the description field empty |

| Convenience | Requires an in‑person meetup | Instant |

Key takeaway:

- Cash: Best when you need complete anonymity and can meet in person.

- Bank transfer: Ideal if you value speed and convenience over perfect secrecy.

How to Conceal a Bank Transfer

This applies only if you buy crypto using a bank transfer.

- Start the bank transfer

Leave the description field blank. The empty memo gives you maximum flexibility and hides any link to cryptocurrency from the bank’s records. - Be ready for questions

If your bank asks why the money was sent, follow this quick blueprint:

- Check the amount against your country’s gift‑tax exemption

- If it is below your country’s gift‑tax exemption, state that it was a donation. No further steps needed.

- If it exceeds the limit, claim it was a credit instead and move to step 3.

- Prepare a simple credit contract (paper only)

- “The transfer of [amount] was a loan to be repaid in cash.”

- Date the agreement before the bank payment is made. No actual repayment is required. Just a written understanding for later reference.

- If the bank or tax office continues to inquire later

- Tell them the loan was paid back in cash shortly after it was issued and show a basic cash‑receipt as proof.

- Because the interest is negligible, the transaction can be treated as a gift that usually falls below taxable thresholds.

By following these steps, you keep the bank transfer low‑profile while retaining the flexibility to explain it later if necessary.

Crypto Community and Bitcoin Miner

Buy crypto from the community you personally meet at events. It's a great way for high‑privacy one‑off trades.

If you're looking for a reliable way to regularly trade fiat for crypto, you can also build relations with Bitcoin miners. For instance, attend Bitcoin events and create connections. If you’re legitimate, you’ll be able to establish trust.

For guidance on whether to use cash or a bank transfer—and how to phrase the transaction so it stays low‑profile, see the Trusted Family & Friends section above.

Specialty Set-Ups

High‑privacy approaches that go beyond standard methods are sometimes used to obfuscate large‑scale acquisitions.

These fall under what I call specialty set‑ups and can include:

- Offshore Entity Formation for Layered Privacy – creating a shell company in a privacy‑friendly jurisdiction.

- Irrevocable Trust Structures with Professional Trustees – placing assets under a trust managed by nominees.

- Intermediated OTC Desk Transactions – using a broker or law firm to submit KYC on your behalf for an OTC trade.

- Private Institutional Placements and Brokered Deals – working directly with institutional desks that accept entity‑level verification.

These paths can offer greater privacy than standard centralized exchanges, but complete anonymity is rarely achievable because registered agents, intermediaries, and banks still need to verify identities. I won’t dive deeper into these options in this post.

Gold Dealer - Not Practical

- Few dealers accept crypto: Most only take cash or wire.

- Regulatory limits: In many countries, only small amounts can be traded without KYC (Germany: €2,000, USA: $10,000), but anything above triggers AML checks (identification required). In the USA, dealers must file Suspicious Activity Reports (SARs) for anything suspicious, regardless of size.

- No‑electronic payments still require identification: Even cash (“unbarred”) transactions are subject to KYC from €0 onward under the EU Travel Rule and similar U.S. regulations.

- High costs & limited liquidity: Typical spread is 8-12 %.

- Result: You lose anonymity, pay more than other methods, and scale is difficult.

Crypto From Illicit Sources (Tainted Coins)

Tainted coins are those that have previously been involved in illicit activity like hacked wallets, ransomware payouts, or any transaction that a regulator may flag.

The idea of “tainting” is a construct introduced by compliance tools and regulators to try to control the flow of digital cash. In a truly permissionless system, every coin should be interchangeable and free from history.

If you keep your funds entirely off regulated actors (centralized exchanges) there is no problem with tainted coins. But if you plan to interact with regulated actors, you must understand how your activity can affect your ability to transfer and sell the coins.

How to Check your Addresses

Checking your address first tells you whether a custodial platform likely will flag it and helps you decide how to proceed.

- Chainabuse.com: Search for Bitcoin or Ethereum addresses (free account, use an anonymous email). It lists community‑reported scam activity and blacklisted addresses.

- Blockchair: Search for Bitcoin, or Ethereum addresses to see if the address is on sanctions & blacklists reports, used for scams and has a high AML risk.

- Etherscan.io: Enter any Ethereum address and click the Cards tab. The “Wallet AML Risk Score” tells you whether a custodial exchange is likely to run an AML check if you send coins there.

Do I Need to Worry If I have Received Tainted Coins?

You do not need to panic, but you should consider a few things:

- Centralized exchanges may refuse deposits or trigger a full source‑of‑funds check if your wallet shows a high risk score. Expect a lengthy AML review when you try to off‑ramp through a custodial platform. Use them only if you are prepared for it.

- Decentralized protocols (Uniswap, Aave, etc.) let you trade freely.

- Use anonymous off-ramps (sell crypto for fiat) through non custodial platforms like P2P Platforms and OTC Desks to avoid AML checks.

- Keep all anonymously acquired coins separated. Do not transfer them to a custodial exchange or platform.

Can I clean my coins?

“Cleaning” tainted coins is only relevant if you want to interact with regulated actors (Kraken, Coinbase etc.). The safest route is simply to stay away from them.

Because tainting is a regulator‑driven compliance concept, there is no foolproof method to remove it completely.

I’ll publish a separate post on techniques for reducing AML risk when dealing with anonymously bought coins. Stay tuned!

Questions, ideas, or feedback? Reach me at cassius.nox@tuta.com.

You can check the fees for buying at a crypto ATM by region on Coin ATM Radar ↩︎